All Loans Under One Roof by APPLYTOLOANS.COM +📞9015552537 Your One-Stop Loan Solution in India

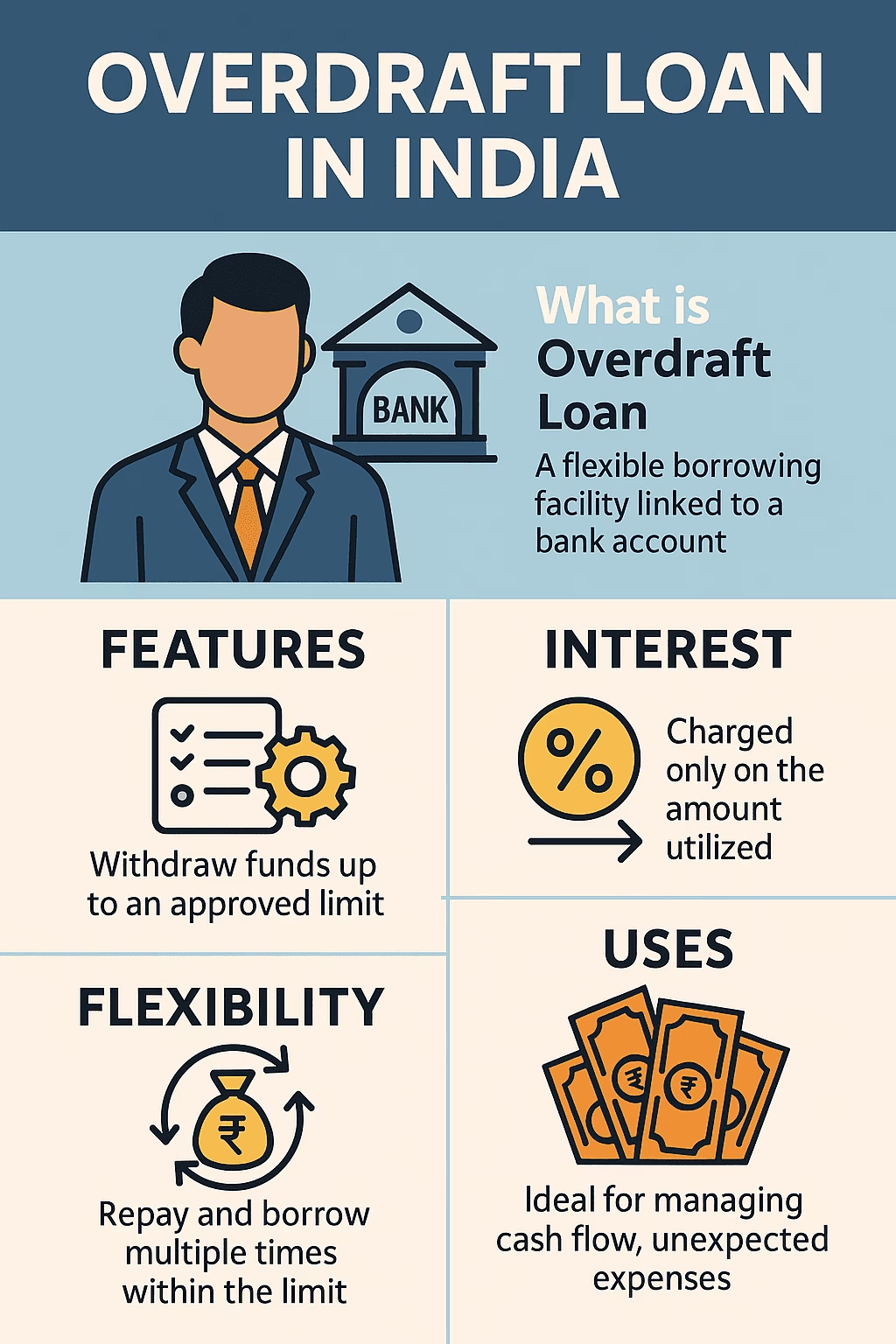

APPLYTOLOANS.COM is a trusted loan services provider in India, it offers all loans under one roof India, making borrowing easier, faster, and more transparent. Whether you need a Personal loan, Home loan, Business loan, Loan against property, Overdraft facility, Machinery loan, Gold loan, or even a used car loan, APPLYTOLOANS.COM brings it all together in … Read more